Every time there is a transaction on the blockchain, a mining fee is charged.

Mining fees pay for the computing power it takes for a transaction to be verified on a cryptocurrency network. Mining fees are given to the miner, or computer, that performs the work to verify the next block of transactions added to the blockchain.

The mining industry frequently entails fees. What is a mining fee, and who is responsible for paying it? We’ll discuss everything below.

What is a Mining Fee?

Miners receive compensation for their efforts in validating and growing the blockchain network, either in the form of Bitcoin or a percentage of the harvested fees.

Mining fees are similar to transaction fees that you may be charged by banks or merchants. The resources needed to manage a credit card and the back end of a transaction are not free. Merchants frequently take on the expenses.

For instance, if you swipe your credit card at a large chain store, it’s unlikely that the business will charge you a fee for the transaction because they cover the expense. However, if you visit a tiny, mom-and-pop eatery, they might charge you a processing fee for your credit card (typically around 2%).

A fee incurred for conducting business between two different currencies is a foreign transaction fee, which is another similar kind of fee.

Fees for miners are comparable to those for processing. In other words, miner fees serve as a financial incentive for miners to verify and secure the network while processing transactions on the blockchain.

What Do Mining Fees Do?

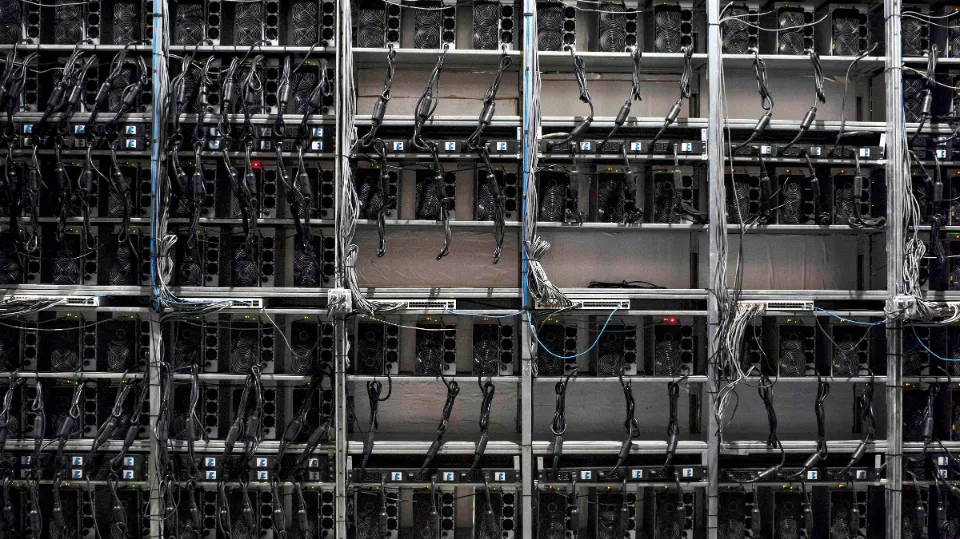

Blocks are added to the blockchain by miners, who also secure and confirm transactions. A block is a collection of transactions. The shared public record of every transaction is the blockchain. To make a transaction final, miners must add it to the blockchain. Once a transaction is added to the blockchain by miners, it cannot be undone. How are bitcoin block confirmations carried out?

Miners choose which transactions to confirm first based on the miner fees associated with those transactions. It is more likely that your transaction will confirm quickly if the miner fee is sufficient. Your transaction might take days or even weeks to confirm if you use a low miner fee (or none at all). Other cryptocurrencies may behave differently in relation to this point; the bitcoin network may even completely reject your transaction and return the money to your wallet.

Who Pays Bitcoin Mining Fees?

The answer to the question of who pays mining fees depends on a number of variables.

Keep in mind the example from earlier comparing big-box store credit card transaction fees to small mom-and-pop restaurants. Mining fees operate under the same dynamic. You might or might not be liable for paying them, depending on the exchange you’re using to trade your cryptocurrencies.

Coinbase, for example, “incurs and pays these fees directly,” according to company documents. As with paying a commission to a stockbroker to execute a trade, Coinbase also charges a fee to end users for carrying out the transaction. A transaction fee of this kind is essentially the same as paying a mining fee to Coinbase, albeit in a different format.

Kraken, another popular crypto-trading platform, likewise charges small “trade fees” to execute transactions. Another well-known platform, Binance, levies trading fees but gives discounts to some users and those who use its proprietary token, BNB.

How to Send Mining Fees?

The majority of genuine wallets incorporate a miner fee into each transaction. Change your settings to include a dynamically calculated fee to ensure that your wallet includes the proper miner fee. Due to the network being busy, this will help ensure that your transaction arrives on time.

This setting is included by default in wallets like the BitPay Wallet. Just before you complete the transaction, keep in mind that you can only alter the fee.

Please take note that not all bitcoin exchanges will send a miner fee when transferring money. The miner fee cost will be subtracted from your outbound transaction instead.

What Determines Mining Fees?

Depending on the particular blockchain network in question, a Bitcoin miner fee may have a different value. There will be a range of calculation techniques used across blockchain networks.

However, in general, a mining fee will be determined by the size of the transaction as well as the current state of the network. Similar to how a ridesharing app determines prices while in use, it takes into account the market’s current conditions (i.e., supply and demand) and ultimately determine the end price.

Mining costs on the Bitcoin blockchain network are determined by the supply that is readily available and the corresponding demand for blockchain space. The network becomes crowded when there are many transactions to process because there is fierce competition for available space. Fees, therefore, rise as a result. And vice versa.

For instance, in the spring of 2021, the cryptocurrency market was booming and trades were occurring everywhere. Fees increased as a result; at one point, they averaged more than $62.

But as things calmed down in the months that followed, prices dropped. Fees ranged between $3 and $4 throughout the 2021 late summer and early fall.

If you find yourself asking “why are mining fees so high,” the answer is likely because many other traders are trying to execute transactions at the same time you are.

How Do Mining Fees Work in the ETH Network?

While fees on the ETH network operate in a manner similar to that previously described, there are some significant variations.

The Gas fee is what Ethereum charges. Ethereum transactions are instructions executed on the Ethereum network, each instruction has an associated cost in Gas units, and Gas is calculated as follows:

Gas = Gas Limit x Gas Price

The amount of Gas and the Gas price depends on how congested the network is and how many instructions are needed to complete the transaction.

The most amount of Gas units you will spend on the transaction broadcast is known as the “Gas limit.” Gas limit works as follows:

• The transaction will be processed if you enter the precise amount of Gas needed (this is difficult to determine; the BitPay app estimates it for you).

• The transaction will fail and the Gas will be used if the included Gas limit is less than what is needed. There will be no refund in this situation.

• If the Gas limit is higher than what is needed, the extra Gas units are returned to your wallet instead of being used.

The transaction is not broadcast but the fees are used when ETH transactions fail due to a low fee or a contract issue. Again, the miners receive these fees, not BitPay.

What About ERC20 Tokens (USDC, BUSD, WBTC, Etc)?

On the Ethereum network, each token transaction results in the execution of one or more contracts. To send tokens out of your wallet, you must have enough Ether in the Ethereum wallet connected to the token wallet to cover the transaction cost. Gas is paid in Ether when you make a payment with either Ether or any Ethereum token.

Bitcoin Mining Fee Example

Here’s how a crypto investor might run into a transaction, trading, or mining fee:

Assume you want to send your friend F one bitcoin while using an exchange. In a technical sense, you are sending F’s an amount of X Bitcoin from your address, or cryptocurrency wallet. You authorize the transaction using your keys by providing F’s address (or public key), your bitcoin address, and the amount you wish to send.

A message is then sent to the network containing that information, and it reaches a mining node, where miners get to work validating and verifying it, and “mining” a new block on the blockchain. You will be informed of the applicable mining fee for carrying out the transaction before that change to the network occurs; this fee will vary depending on the size of the transaction and how busy the network is.

In most cases, this fee is included in your transaction order and is paid in bitcoin. The fee is paid to the miners doing the “mining” on the blockchain.

You will have effectively sent F one bitcoin plus X% of a bitcoin (or whatever the fee is at the time) as a mining, trade, or transaction fee.

The Takeaway

Even though cryptocurrencies are decentralized, they are not a free-for-all market. And that’s especially true when it comes to paying fees that are necessary to complete transactions, like mining fees.

Miners get paid to validate transactions, and their fee comes from somewhere — often, from the person initiating the transaction.

FAQs

Why is My Mining Fee So High?

Supply and demand are the main causes of high bitcoin miner fees. Since each block in the bitcoin network is 1MB in size, miners can only confirm transactions totaling up to that amount. A block is generated every ten minutes.

How is Mining Fee Calculated?

The size of the transaction being sent in bytes determines how much the miner will charge. The amount of bitcoin that is spent has no bearing on miner fees. The standard unit of measurement for the fee rate is Satoshi/byte. The smallest bitcoin unit is Satoshi (0.00000001 BTC).

What Time of Day Are Mining Fees Lowest?

Costs are at their lowest on weekends between 10 pm and 11 pm UTC. The majority of transactions are carried out in the United States, so keep that in mind., Gas prices have historically been lower on Saturdays and Sundays because fewer people are working, especially in Europe and Asia.

How Long Do Miner Fees Take?

Before being processed, all Bitcoin transactions require six blockchain confirmations from miners. Most Bitcoin transactions take between one and five hours to complete.