Bitcoin Gold (BTG) is a forked version of Bitcoin that took place in October 2017. In short, the stated purpose of the fork that created Bitcoin Gold was to “make Bitcoin decentralized again”.

Due to the use of the Proof of Work algorithm Equihash, which is ASIC resistant, Bitcoin Gold has largely managed to avoid this. That implies that it is still possible to mine Bitcoin Gold using a home computer, making mining more available and decentralized.

Keep reading to learn more about bitcoin gold pools.

What is Bitcoin Gold Mining?

Traditional forms of financial systems have banks that act as middlemen, helping two parties conduct transactions. They have control over their users because they are the custodians of the data and are accountable for updating ledgers or records. This can result in power abuse, and there are numerous instances in history of banks mismanaging their customers’ funds and even restricting the flow of money, even freezing accounts and leaving people stranded.

There are no banks on the Bitcoin Gold network, and miners are responsible for updating the ledgers and validating all transactions. BTG is open to all participants to attempt transaction validations in order to ensure that no single entity emerges among the miners. All they have to do to solve puzzles is use their computers. With this open-ended algorithm, the miner who solves the equation first has the opportunity to append the transactions that make up a block. Block rewards, which are distributed in the form of Bitcoin Gold tokens, serve as miners’ rewards for their labor.

Why Bitcoin Gold Miners Are Important?

Miners validate transactions and update the ledgers of the digital currency. They make sure that wallets are debited and credited so that no one can spend their coins more than once by timely updating and broadcasting the information on the Bitcoin Gold network. This is called the “double-spend problem”, and before Blockchains, a brilliant idea from Satoshi Nakamoto was the key to defeating all prior attempts to develop a useful digital currency.

Like its original blockchain, Bitcoin Gold uses game theory models and requires miners to invest computing power to solve mathematical equations in order to validate transactions. Block rewards provide them with motivation to continue working as a result of the incentives they receive. As more miners join the network, Bitcoin Gold raises the difficulty of the validation puzzles to maintain competition and the stability of the system. The amount of computing power dedicated to the network is measured in “hashes.”

What to Look for in a Bitcoin Gold Mining Pool?

Many of these characteristics have already been discussed because they are fairly common in mining pools. Since these are in place, any mining pool is just as good as another mining pool; the decision ultimately comes down to the user’s preferences. So, without further ado, here’s what to look for in a good Bitcoin Gold mining pool:

Fees

The one feature that, in the long run, will distinguish one pool from another is probably this one. The pools with the lowest fees will be your best option, as you may have already guessed when all other factors are equal. Anything less than the average fee of 1% is considered to be a good deal.

Server Location

There is no negotiating on this aspect. Servers must be located reasonably close to your location. When I say “somewhat close,” I mean that Europeans should pick a mining pool with servers in Europe (possibly as far away as Russia), and North Americans should pick a pool with servers in North America. There will be less latency and more hashing power available to the pool as the server gets closer to your location.

Trustworthy

Avoid picking a pool just because it’s nearby and has no membership fees. It should also be reliable. Before using the pool, do some research and look up what other people have to say about it. Or just give it a shot and see if they pay promptly and in full.

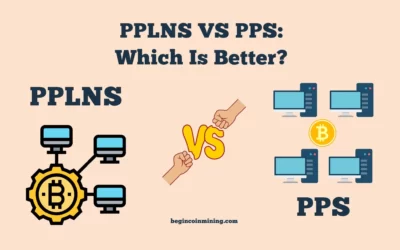

Payout Scheme

This is something you’ll need to look at and decide how important it is to you. Mining pools offer a wide range of different payout plans. Some are geared more towards luck, while others look to make payouts as fair as possible based on contributed hash power. Pay per Share (PPS) and Pay per Share Plus (PPS+) are two well-liked schemes that eliminate miner risk by having the pool pay a flat fee for each share solved. Pay Per Last N Shares (PPLNS), which pays out as a percentage of the shares that are added to the total number of shares (N), is another well-liked payout scheme.

Pool Uptime

The pool’s uptime needs to be as close to 100% as possible, which isn’t always simple to find but try. Not mining means that the pool servers are down. And you’re losing money as a result.

Minimum Payout

A lower minimum payout is preferable because you get paid more quickly, but it’s not a huge deal and probably won’t be a deal breaker if everything else looks good. This won’t be a major concern for you if you’re not overly concerned with getting paid quickly.

Pool Hash Power

Here, you need to strike a balance a bit. One advantage is that you want a well-liked pool with a lot of hashing power because that pool will be uncovering the majority of blocks. On the other hand, if the hashing power is too high, you run the risk of centralization and perhaps even a 51% attack. A good rule of thumb is to look for the greatest hash power, but not greater than 25% of the total. Simply for the sake of the network’s health, you should select a different pool if a pool already controls more than 25% of the hash power.

Bitcoin Gold Pool Mining Vs Solo Mining

You have the option of mining Bitcoin Gold either alone (solo mining) or in a pool with other users. The difference is when you’re solo mining all the hash power is coming from your computer(s), making it less likely you’ll find a block, but when you do you get to keep the entire reward.

When you mine in a pool, you pool your hashing power with the hashing power of hundreds or thousands of other people. You’ll find a lot more blocks as a result, but the rewards will also need to be split.

If you have a lot of powerful video cards at your disposal to mine with, solo mining is possible if you have a lot of hash power. But reward payouts from pool mining are more even. If you solo mine you might not find a block for weeks, and you’ll get paid 12.5 BTG when you do.

Your daily pay will be much less if you pool your mining. Your contribution to the pool’s hash power will determine how much you receive. Consequently, each time a block is discovered by the pool, you will receive 1%, or 0.125 BTG (fewer fees), if your hash power represents 1% of the total pool hash rate.

Alternatives to Bitcoin Gold Mining

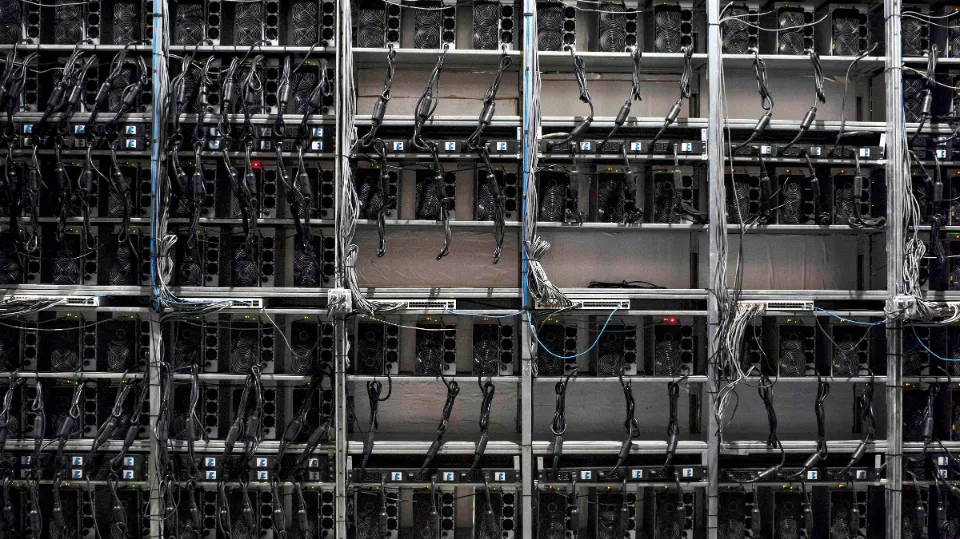

Not everyone should get into mining because it can be very expensive and time-consuming to get the right hardware and power it. You might also find yourself in competition with large-scale mining operations like Riot Blockchain, Marathon Digital Holdings, and Argo Blockchain.

Purchasing shares in one of these mining companies are an easier and more affordable way to make money from mining. Signing up with a broker that sells stocks of mining companies makes this simple. You can get started by clicking on the link to our preferred partner below.

Riot Blockchain (RIOT)

Riot Blockchain has Bitcoin mining facilities in New York and Texas, including North America’s single largest Bitcoin mining and hosting facility. Through the expansion of its operations and the acquisition of additional mining equipment, the company hopes to increase its capacity and hash rate.

Marathon Digital Holdings (MARA)

Since 2010, when it first began accumulating encryption-related patents, Marathon Digital Holdings has been a provider of digital asset technology. The company is already in possession of a sizable fleet of Bitcoin miners, and it wants to create the biggest mining operation in North America while minimizing its energy usage.

Argo Blockchain (ARB)

The dynamic team at Argo Blockchain is made up of experts in blockchain technology and mining. The company supports the development of blockchain technologies and advocates the use of renewable power sources to create a sustainable blockchain infrastructure.

Conclusion

Mining Bitcoin Gold is a good choice for the home miner since it uses the ASIC resistant Equihash algorithm. Home miners should be able to continue their mining activity as long as it is profitable for them because the Bitcoin Gold Foundation is dedicated to keeping the coin ASIC resistant.

To help you maintain a steady income, there are fortunately many mining pools available. With a 1% fee and 0.01 BTG minimum withdrawal being pretty standard among these pools it really won’t matter which one you choose. The only thing we can suggest is that you try to pick one of the small to medium-sized pools to keep network centralization at a high level.

Although there was some controversy surrounding Bitcoin Gold when it first launched, there hasn’t been any bad press in the interim, and the coin has continued to gain popularity even though its price has decreased as the cryptocurrency markets have experienced a general decline.

Mining now might be a wise decision because once cryptocurrency markets as a whole recover, the value of your mining rewards could double, triple, or even increase.

FAQ

What is the Reward for Finding a Block?

12.50 BTG is the current payment.

Is It Possible to Use a Hash Rental Or Cloud Mining for Bitcoin Gold?

Yes, some cloud mining and hash rental services work with the Bitcoin Gold algorithm. The best cloud service provider is nicehash.com.

What is the Bitcoin-Gold Mining Pools Reward Systems?

Various, based on the rewards that the pool views as appropriate. The most typical is proportional among miners.