Learn more about how to report Bitcoin mining taxes, what expenses might be deductible and how to minimize your crypto taxes to increase your profits.

Here are quick steps on how to report Bitcoin Mining taxes:

- Learn Bitcoin Mining Activities as Taxable Events

- Figure out your Bitcoin mining purpose: Bitcoin Mining as a Hobby or Bitcoin Mining as a Business

- Determine Bitcoin mining business expenses: Equipment, Electricity, Rented Space, Losses

- Minimize Crypto Taxes

- File Your Bitcoin Mining Taxes: Keep Records of All Transactions, Fill Out the Proper Tax Forms, File Your Taxes

- Or Hire a Professional

Bitcoin mining earnings are taxed as income in the United States. You need to report your Bitcoin mining income to the IRS as part of your annual tax return. Keep reading for everything you need to know about Bitcoin Mining taxes.

Key Takeaways:

- Bitcoin mining profits are taxed as capital gains when sold and as income when received.

- If you mine bitcoin for a living, you might be able to write off some expenses.

Do You Pay Taxes on Mining Bitcoin?

Yes, mining bitcoin, Ethereum, or other cryptocurrencies is taxed in two ways:

- As regular income at the time of mining

- As crypto capital gains when the mined tokens are disposed of at a later date

When cryptocurrency is deposited into your wallet after being earned, a crypto taxable event is set off. Accordingly, regardless of any gains or losses in the value of the cryptocurrency during the remainder of the tax year, you will be required to pay mining taxes on the amount earned at the time it is earned. In light of this, it is crucial to maintain thorough records of all bitcoin or other cryptocurrency mining activities, including the dates on which coins were earned, their total number, and their market value at the time of earning.

If the value of your mined cryptocurrency has increased by the time you sell it, you may also be subject to capital gains taxes. Using the aforementioned example, if you sold the 0.25 BTC you mined for $9,000 and it has since appreciated to $11,500, you would be required to pay capital gains tax on the $1,500 gain.

How Are Nodes Taxed?

In order to validate transactions and achieve consensus, validator nodes constantly run online software and maintain a current copy of all or a portion of the chain’s ledger. Validator nodes are not compensated financially on proof-of-work (PoW) chains like Bitcoin; rather, their work enables miners, who compete to calculate hashes quickly enough to add new blocks to the ledger and earn bitcoin in return.

However, on proof-of-stake chains, like Ethereum 2, blocks are not “mined,” rather they are “forged” or “minted” by the validator nodes themselves, which are required to have staked coins to the network. Stakers receive coins whenever a node is chosen to include a new block. Similar to how cryptocurrency that is mined would be, these rewards are taxed as income.

Bitcoin Mining Activities as Taxable Events

There are two different tax recognition events that mining bitcoin might be subject to. The first tax event occurs when the taxpayer “mines” cryptocurrencies and receives new cryptocurrency as a reward. When the taxpayer later disposes of their new cryptocurrency, it results in the second tax event. The first transaction is subject to ordinary income tax, whereas the second is subject to capital gains tax.

- First taxable event: The first tax trigger for mining activities takes place when cryptocurrency is deposited into the taxpayer’s wallet as a result of successfully verifying or “mining” transactions. So, at the time the mined income is earned, the taxpayer will be responsible for paying taxes on it. This is true regardless of whether the value of the cryptocurrency mined results in a gain or loss the following year.

- Second taxable event: When the taxpayer sells, trades, or otherwise disposes of the cryptocurrency they mined, that action constitutes the second tax trigger for those activities. The sale or disposal will result in either a capital gain or loss for the taxpayer. A short-term capital gain or loss exists if the cryptocurrency was held for less than a year. Having held the cryptocurrency for more than a year results in a long-term capital gain or loss.

How Do I Report Bitcoin Mining Income on My Taxes?

Whether you mined cryptocurrency for a living or for living-related purposes will affect how you report your earnings. There are advantages and disadvantages to each strategy; the choice is ultimately up to you.

Bitcoin Mining as a Hobby

Bitcoin, Ethereum, or other cryptocurrencies mined as a hobby is reported on your Form 1040 Schedule 1 on Line 8 as “other Income.” The tax rate is determined by your income bracket.

The simplest method of mining taxes is this one. However, hobby mining is not allowed to be deducted as a business expense.

Bitcoin Mining as a Business

You must incorporate or set up your mining operation as a sole proprietorship in order to establish it as a business. Sole proprietorships do not need to file any legal documents, but they also do not provide liability insurance. Because of this, a lot of people decide to incorporate their cryptocurrency business as a pass-through entity (a partnership, LLC, or S Corp), or as a C corporation.

You might be required to file and pay cryptocurrency self-employment taxes for your mining business, depending on the legal structure you select. Bitcoin earnings are shown as income on your Form 1040 Schedule C if you decide to run your mining operation as a business.

You may deduct some of your mining expenses as business expenses once your mining operation has been recognized as a business.

Deductions for Bitcoin Mining

Because mining is an expensive process, there are incentives to treat it like a business and deduct expenses. Miners should always consult with a crypto tax professional to determine which deductions are appropriate. In case of a crypto tax audit, be sure to keep thorough records of any deductions that you claim.

Some common mining business expenses include:

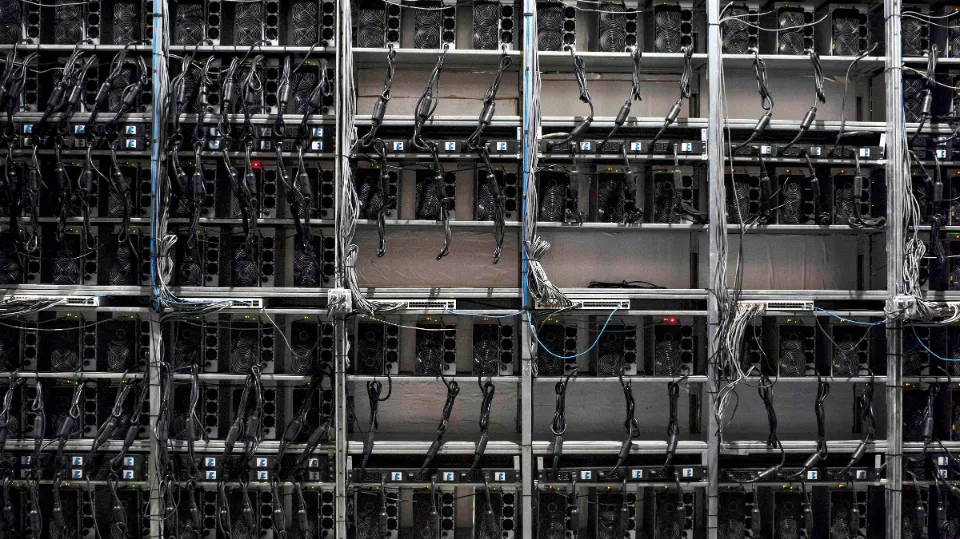

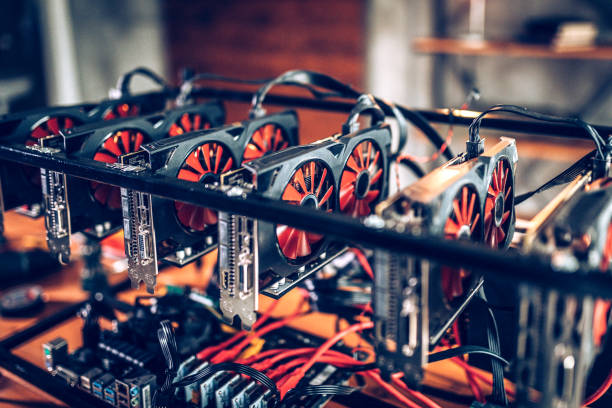

Equipment

Most of the time, the cost of a bitcoin mining rig can be written off as an expense in the year it is purchased using a Section 179 depreciation deduction. This method enables businesses to treat tangible business-related purchases as expenses rather than having to capitalize and depreciate them.

If your crypto tax expert determines that a Section 179 depreciation deduction is not appropriate for a mining-related purchase, the cost of that equipment may be written off over the course of several years (typically 3 to 5), using the modified accelerated cost recovery system (MACRS).

A trade or business expense deduction could also be made for the price of repairs made to mining equipment.

Electricity

One of the biggest expenses for miners is electricity. A business or trade expense is the cost of electricity used only for mining. This means that if you mine bitcoins at home or on a property where electricity is used for other things besides mining, you can only deduct the amount of your electricity bill that is directly related to mining bitcoins.

Be sure to meticulously record the electricity used by your company. For this calculation, a different meter might be useful. For more information, speak with a crypto tax accountant.

Rented Space

You might be able to write off the rental costs for the space you rent to store and operate your bitcoin mining equipment. Your home will be treated similarly to a home office if you have mining equipment there, making it potentially more challenging to deduct the costs.

To find out if you qualify for a tax deduction for expenses related to using your home for business purposes, review the regulations governing the home office deduction.

Losses

Due to the hardware and electricity costs associated with a bitcoin mining rig and the erratic nature of the cryptocurrency market, it is possible for a mining operation to experience a loss during a tax year. Losses in this situation might be able to cancel out other income.

How to File Your Bitcoin Mining Taxes

Organizing your bitcoin mining taxes can never be started too early. You are now questioned about your participation in virtual currency transactions on the common Form 1040 tax return. You need to report your Bitcoin mining income to the IRS as part of your annual tax return.

1. Keep Records of All Transactions

You must maintain a record of every cryptocurrency transaction you make, including the cost of the cryptocurrency, how long you held it, and the price you received when you sold it. You should also keep receipts for each transaction.

The cost basis, or the initial amount you paid for your cryptocurrency, may not be recorded by your crypto exchange if you transfer coins between offline cold wallets and your account, even though your crypto exchange may provide a 1099-B reporting your crypto transactions to the IRS and you.

To help address issues like these, “software companies have emerged that will scrub the blockchain to detect transfers between your wallets, whether on an exchange or not, and give you reports of all transactions related to the wallets you give it within a given tax year,” says Baker Botts partner in tax Jon Feldhammer

2. Fill Out the Proper Tax Forms

Once you have a record of your crypto transactions, you’ll need to fill out certain tax forms depending on how you used your crypto:

- Form 1040. This is the standard form you’ll use to file annual income taxes. On the form, there’s a line to report your total gains or losses from Bitcoin.

- Form 1099-NEC. It’s considered taxable income and you might need to fill out this form for Bitcoin mining.

- Form 8949. This form records each purchase or sale of cryptocurrency as an investment. This should include the total number of coins, the date and price at which you purchased them, the date and price at which you sold them, and your profit or loss on each transaction.

- Schedule D. This form lists all of your investments, including cryptocurrency, and the total capital gains and losses you have made.

- Schedule C. If you received coins from mining, you must state whether you did so for profit or pleasure. If you operate a cryptocurrency mining business, you might have to pay self-employment taxes if your earnings were higher than your outgoings for the year.

- Schedule 1. If you declare your cryptocurrency mining as a hobby, you would list this income on Line 8 of Schedule 1. Although you won’t have to pay self-employment tax, your list of allowable expenses will be smaller.

3. File Your Taxes

You can sync your online tax software of choice with any software you use to keep records, such as CoinTracker or Koinly. After that, file your overall state and federal tax returns using the online tax software.

4. Hire a Professional

Since the laws governing cryptocurrencies are constantly changing, preparing for them can be challenging. If you’ve earned a sizable income from cryptocurrencies, it might be worth it to hire a certified public accountant (CPA) who specializes in this area of tax preparation so the IRS won’t come after you down the road.

Bitcoin Mining Tax Reporting Example

The ideas presented in the Notice above might be best understood with the help of an example. Let’s say Adam mines Bitcoin and receives 6 tokens at a $45,000 per coin price. Adam will be subject to ordinary tax rates on the $270,000 ($45,000 x 6) worth of Bitcoin he receives if it is assumed that his mining activities are considered a trade or business or that he is employed as an independent contractor. In both cases, Adam will also be required to pay quarterly estimated tax payments and be subject to self-employment taxes. Adam will receive a Form W-2 each year if he performs mining as an employee, and the $270,000 he earns will be subject to federal income tax withholding.

When a miner sells the reward tokens, it will result in a second taxable event. The gain (or loss) will be equal to the difference between the sales price and the taxpayer’s gross income from the time the taxpayer first received the coins in exchange for engaging in mining activities. Let’s use Adam as an example, and imagine that he sold three of the Bitcoin tokens two years later, when the cost of each coin is $60,000. ([$60,000 x 3 tokens] – [$45,000 x 3 tokens]) Adam would see a gain of $45,000. Given that Adam owned the three Bitcoins for more than a year, his gain would be taxed at the lower long-term capital gains rate.

Tax Liabilities When Sell Mined Bitcoin?

Bitcoin sales, whether they are mined or not, are taxable events.

You either experience a capital gain or loss when you sell cryptocurrency. When determining capital gains and losses, the cost basis of the asset is subtracted from the sale price.

The price of the cryptocurrency at the time it was mined (the sum included as ordinary income) is what you should consider your cost basis. To determine whether you made a profit or loss on the sale of the tokens you mined, deduct this amount from the sale price.

You have a capital gain if the cryptocurrency’s value is higher at the time of sale than your cost basis. Taxes on cryptocurrency gains vary depending on your income and holding period.

You will have a capital loss if the value is lower, which you can use to offset your gains using a technique called tax-loss harvesting.

Form 8949 must be filled out for each sale or exchange of mined cryptocurrency.

Read More: How to Sell Bitcoin on Phemex

How to Minimize Crypto Taxes

If you think you might owe cryptocurrency taxes in the future, here are six ways to help minimize them:

1. Hold Cryptocurrency for the Long-Term

Gains from cryptocurrency investments are taxed at the favored long-term capital gains rate if you hold them for at least a year before selling them. Depending on your taxable income for the year, this can almost cut your tax rate in half, from a maximum rate of 37% for short-term gains to a maximum rate of just 20% for long-term gains.

2. Offset Gains With Losses

You can benefit from cryptocurrency gains by deducting losses from other investments in the year you realize your profit, just like with any other investment. In other words, if you made $10,000 from selling Bitcoin but lost $10,000 from selling Ethereum, you would have made a profit of $10,000 and not lost $10,000 in tax.

Other cryptocurrencies are not exempt from these losses, though. Check the rest of your portfolio if there are any other losing investments you could sell to offset your gains if you are about to cash in a sizable crypto investment. In addition, if you lose a lot more money than you make in a year, you can carry forward any unused losses to offset future investment gains and deduct up to $3,000 in excess losses from your personal income taxes.

3. Time Sales With Your Tax Rate

Jeff Hoopes, an associate professor at the University of North Carolina and the research director of the UNC Tax Center, advises that if you have the luxury of time on your side, you can always try to wait out a lower tax rate.

“You might have moved to a state with lower taxes, retired, gone back to school, or been laid off. Then you might find yourself in a lower tax bracket, which would allow you to sell your crypto while owing less in taxes,” he says.

4. Claim Expenses for Mining

Despite having a low initial cost, mining cryptocurrency involves significant costs, such as those for computers, servers, electricity, and internet service providers. If you mine cryptocurrencies, you can deduct these expenses from your mining income. However, the amount you can deduct will vary depending on whether you classify your operation as a business or a hobby.

5. Consider Investing through a Retirement Plan

Although it’s more difficult than using a standard brokerage account, investing in cryptocurrencies through a retirement plan like a traditional IRA or Roth IRA allows you to delay or completely avoid investment gains.

“There are ways to get crypto into tax advantaged vehicles like an individual retirement account (IRA), but it is not that common and not that easy (although many expect it to get easier),” says Hoopes. Currently, if you wanted to open a cryptocurrency or Bitcoin IRA, you would have to do so through specialized accounts known as self-directed IRAs with small businesses that offer cryptocurrency investing.

6. Donate to Charity

If you decide not to use the entire profit from your cryptocurrency investment, you can reduce your tax liability by giving at least a portion of it to charity. You will receive a deduction equal to the full value of your cryptocurrency, including any gains. But in most cases, this only makes sense if you already planned to give to charity.

Bitcoin Mining Tax Takeaway

In the end, the reward tokens that taxpayers receive in exchange for engaging in mining activities are initially taxed as ordinary income. Depending on whether the taxpayer is mining for a living or a business, as an independent contractor or as an employee, the received tokens may also be subject to self-employment or payroll taxes. Depending on how long the taxpayer holds the reward tokens, selling them will result in another taxable event that will be subject to either short-term capital gain rates or the more advantageous long-term capital gain rates.

Hope these steps are helpful for you to report Bitcoin Mining on taxes:

- Learn Bitcoin Mining Activities as Taxable Events

- Figure out your Bitcoin mining purpose: Bitcoin Mining as a Hobby or Bitcoin Mining as a Business

- Determine Bitcoin mining business expenses: Equipment, Electricity, Rented Space, Losses

- Minimize Crypto Taxes

- File Your Bitcoin Mining Taxes: Keep Records of All Transactions, Fill Out the Proper Tax Forms, File Your Taxes

- Or Hire a Professional

FAQs

How Can I Report Crypto Staking Rewards on My Taxes?

You can report staking rewards as “other income” on If you run your own cryptocurrency business, you must complete Schedule C on Form 1040.

Do I Have to Report Crypto Losses on My Taxes?

Capital gains on losses from cryptocurrency are exempt from capital gains tax. However, you shouldn’t just write it off as a bad investment because you can use your tax bill to offset your losses against your gains.

Where Do I Report Cryptocurrency on My Taxes?

The IRS treats crypto as “property,” which means you’ll need to report certain crypto transactions on your taxes. You’ll even be asked on the main form, Form 1040, whether you received, sold, sent, exchanged, or otherwise acquired “any financial interest in any virtual currency.”

Overall, how you’ll report that crypto activity and any additional forms you might be required to fill out depend on the type of crypto-taxable event.

How Can I Report Crypto Staking Rewards on My Taxes?

You can report staking rewards as “other income” on If you run your own cryptocurrency business, you must complete Schedule C on Form 1040.