Consider the advantages and disadvantages of mining Bitcoin as opposed to purchasing it to make a better investment decision.

The price of bitcoin has fluctuated a lot this year. In November 2021, the original cryptocurrency reached a high of $69,000, but by December 2022, it had fallen as low as $12,9331. You can buy a bitcoin, receive one as payment, or mine one if you’re interested in getting one. The question still stands: would it be better to buy Bitcoins with $10K today or to use the money to purchase mining equipment and mine them instead?

The purchasing procedure is quite simple and self-explanatory, just like we would buy the necessary quantity of bitcoin by paying for it on any exchange. Purchasing Bitcoin only requires a brief investment and incurs no additional costs. Bitcoin mining is a long-term investment, though. You must first make an investment in mining equipment. The main site and electricity are both extremely problematic, mining is more expensive, and the return cycle is lengthy. Even though mining bitcoin carries greater risks, it also offers a chance to obtain more bitcoin than buying it directly.

We’ll go over these two options in this article and hopefully give you a better understanding of the benefits and drawbacks of mining and purchasing bitcoin.

What is Bitcoin Mining

The process by which bitcoin is validated and recorded on the blockchain is known as mining.

To complete intricate mathematical operations known as hashes, bitcoin miners use powerful computers. The amount of processing power needed to mine one bitcoin is very high, but for each block of transactions in the blockchain that is mined, miners are rewarded with 6.25 bitcoins, or about $143,000.

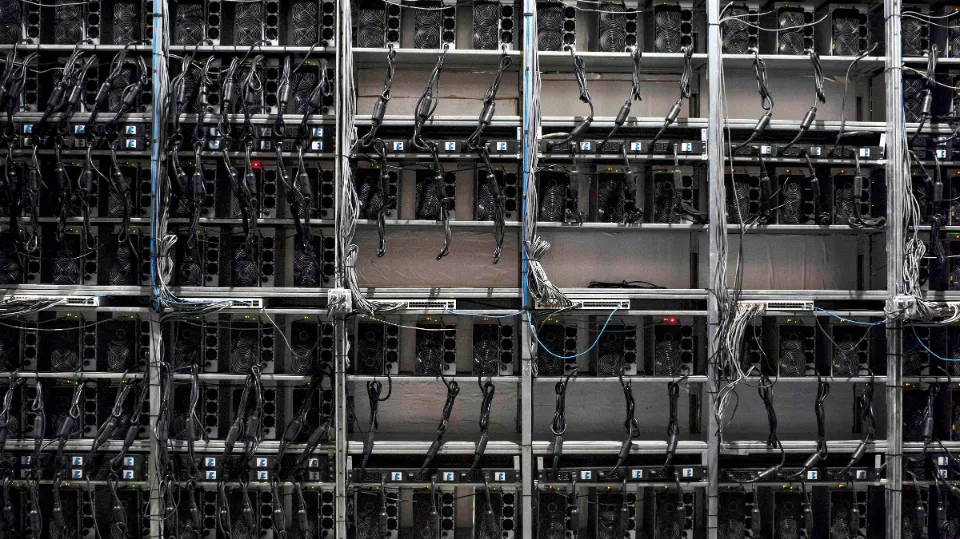

While anyone technically has the ability to mine Bitcoins, the majority of Bitcoin mining is carried out by businesses using massive commercial mining setups that include data centers with specialized servers.

Specialized equipment that is significantly more expensive than GPU equipment is needed for bitcoin mining. GPUs and strong PCs were sufficient to mine Bitcoin and other digital currencies before the “mining era.” However, ASIC (application-specific integrated circuit) mining chips are now used for Bitcoin mining because of the increased complexity of crypto. Bitcoin trading has the advantage over Bitcoin mining because you can get started without investing any money in pricey equipment.

Analysis of newly released chips on the market, their product features, and a variety of other nuances are necessary to accurately track the relevance of ASIC mining and obtain a rough estimate of its return. When compared to GPU mining, ASIC mining requires a much larger minimum investment. Independent Bitcoin mining is currently not profitable. Users prefer to combine their efforts by joining mining pools because there is no return on investment from it.

Electricity is another one of the most important resources, along with equipment costs. You will see a return on your investment more quickly if it is less expensive. The most desirable locations for mining cryptocurrencies are those with the lowest electricity costs. Before investing in new equipment, always take mining profitability in terms of electricity costs into account.

A step-by-step guide to starting mining:

- Bitcoin mining equipment purchase

- Bitcoin mining equipment connection and adjustment

- Software setup

- Independent operation or use of a pool

- Maintenance of system performance and process modifications.

Bitcoin Mining Pros:

- Ability to withdraw profits daily

- full command of the investment.

- Potential to get more Bitcoins

Bitcoin Mining Cons:

- Requires knowledge about computer hardware

- Requires experience in configuring and maintaining PC components

- Must constantly monitor equipment

- Must always keep track of the cryptocurrency market

- Profit is minimal but consistent.

How to Buy Bitcoin

The three key points to consider when buying bitcoin are:

- Payment method

- Platform/venue used

- Where your bitcoin goes

Payment options include credit cards, bank transfers, and payment apps like PayPal, Apple Pay, Google Pay, and Samsung Pay.), face-to-face with cash, and even barter. Convenience, privacy, and related costs can all be compromised by a payment method.

Digital wallet providers, centralized spot exchanges, OTC desks (private “Over-The-Counter” exchange services used primarily by high-net-worth individuals), peer-to-peer marketplaces, and even payment apps like PayPal are examples of platforms or locations where one can purchase bitcoin.

Of course, it is also possible to purchase bitcoin in person. For instance, you could give your friend cash in exchange for an agreed-upon sum of bitcoin.

As for where your bitcoin goes after you buy it, the options are:

- Into a Bitcoin wallet you control

- into a Bitcoin wallet that is managed by a third party (e.g. a centralized cryptocurrency exchange or a payment app like PayPal).

Read More:

Bitcoin Mining Vs Buying: Which is Better?

Therefore, there is no precise response to the question of whether to mine Bitcoin instead of buy it. This is a question that each investor must respond to for themselves. The evolution of the entire cryptocurrency industry is driven by mining, which is the basis for long-term network operation, software development, and mining algorithm improvement. Prior to starting a mining operation, take into account the equipment and electricity costs as well as the length of time it will take to see a return on your investment. This equation includes a lot of factors that can affect mining profitability, but when everything comes together properly, the investment is profitable.

Due to intense competition and large mining farms, lone miners are forced to collaborate in pools in order to profit. Trading can be started with $100, which is a much lower entry threshold than mining. A trader can improve their trading balance by progressively developing their experience and skills. The secret to success is having the capacity to handle a small deposit in the same manner as a large one. Being a great theoretical trader is meaningless. Only by going through wins and losses can one truly develop as a trader. Trading has significantly greater potential risks than mining. However, high, steady profits can be attained with good money management, a successful plan, and emotional restraint.

Conclusion

We can draw the conclusion that trading allows you to make money right away without relying on chance when comparing cryptocurrency mining and trading. It does, however, necessitate expertise and knowledge. In addition, mining puts you in touch with a totally different class of market participants: those responsible for constructing a cryptocurrency network. In this sense, trading is less dependent on chance and more dependent on luck. Additionally, mining requires a bigger financial commitment than cryptocurrency trading.

Mining is for you if you want to consistently make money, learn about and have experience working with computer hardware, don’t mind noise, and want to reduce your investment risks. Go ahead and purchase cryptocurrency if you want to. You shouldn’t bother with mining because you’ll need to search for a profitable cryptocurrency to mine while also paying for electricity and equipment upkeep. It is possible to use this time in another way.

Welcome to the world of trading if you enjoy taking calculated risks in the pursuit of high returns and are willing to lose some or all of your initial investment. You can profit by margin trading cryptocurrencies at a rate of 100% per day (the same as the income from mining), and 500–1000% within six months or even sooner. We wish you success and big profits!

FAQs

Is Bitcoin Mining Worth It?

Yes, bitcoin mining can be profitable if you invest in the right tools and join a bitcoin mining pool. A high profit isn’t guaranteed, though, and there are many unknowns. Not everyone is suited for mining.

Is Bitcoin Mining Better Than Trading?

Working with multiple cryptocurrencies at once and the potential for greater profit than through simple investment are the main benefits of trading over mining. Remember that there are many risks associated with trading.

Can I Get Rich from Bitcoin Mining?

Bitcoin mining can be a lucrative way to make money with Bitcoin, but not for individual investors. Because of the computing power required, the upfront and ongoing costs can far outpace mining rewards earned.

Is It Better to Mine Or Buy Bitcoin

Buying bitcoins is cheaper and more efficient than having to mine them. Mining requires a lot of capital (facility purchase and setup, electricity use, and time), and returns typically depend on how much hash power your mining rig can produce.