Evaluate the Best Bitcoin mining companies to invest in and do your best to determine the true value of the Bitcoin Mining company.

Bitcoin mining stocks may be the answer if you want to invest in bitcoin during this bear market but don’t want to learn how to use a bitcoin exchange, manage cold wallet storage, or become anxious when the price of bitcoin drops.

What are the largest publicly traded bitcoin mining firms, and how are they coping with the crisis? The largest mining stocks, as measured by market capitalization as of December 30, 2022, are presented here:

- Riot Blockchain, Inc. (NASDAQ:RIOT): $572.16 million

- Marathon Digital Holdings, Inc. (NASDAQ:MARA): $397.80 million

- Canaan Inc. (NASDAQ:CAN): $324.20 million

- Hut 8 Mining Corp. (NASDAQ:HUT): $242.81 million

- HIVE Blockchain Technologies Ltd. (NASDAQ:HIVE): $163.56 million

- Bitfarms Ltd. (NASDAQ:BITF): $120.05 million

- Cipher Mining Inc. (NASDAQ:CIFR): $111.70 million

- TeraWulf Inc. (NASDAQ:WULF): $93.12 million

- Iris Energy Limited (NASDAQ:IREN): $60.48 million

- Bit Digital, Inc. (NASDAQ:BTBT): $46.98 million

- BitNile Holdings, Inc. (NYSE:NILE): $35.68 million

- Core Scientific, Inc. (NASDAQ:CORZ): $31.94 million

- Argo Blockchain plc (OTCMKTS:ARBKF): $31.06 million

- BIT Mining Limited (NYSE:BTCM): $14.18 million

- Greenidge Generation Holdings Inc. (NASDAQ:GREE): $12.29 million

The best stocks for bitcoin mining are currently down from their peaks from the previous year. This means that before making an investment, it’s critical to assess the company’s fundamentals and make every effort to ascertain the mining company’s true value. These businesses will be well-positioned to make money as the value of the assets they are mining increases once the crypto winter is over. Keep reading on.

We took a look at all the firms out there that mine Bitcoin and sifted out the top players which were then ranked according to their market capitalization.

Best Bitcoin Mining Companies in the World

Riot Blockchain, Inc. (NASDAQ:RIOT)

Market Capitalization as of December 30, 2022: $572.16 million

Riot Blockchain, Inc. (NASDAQ:RIOT) focuses on Bitcoin mining, data center operations, and electrical products. The company is headquartered in Castle Rock, Colorado.

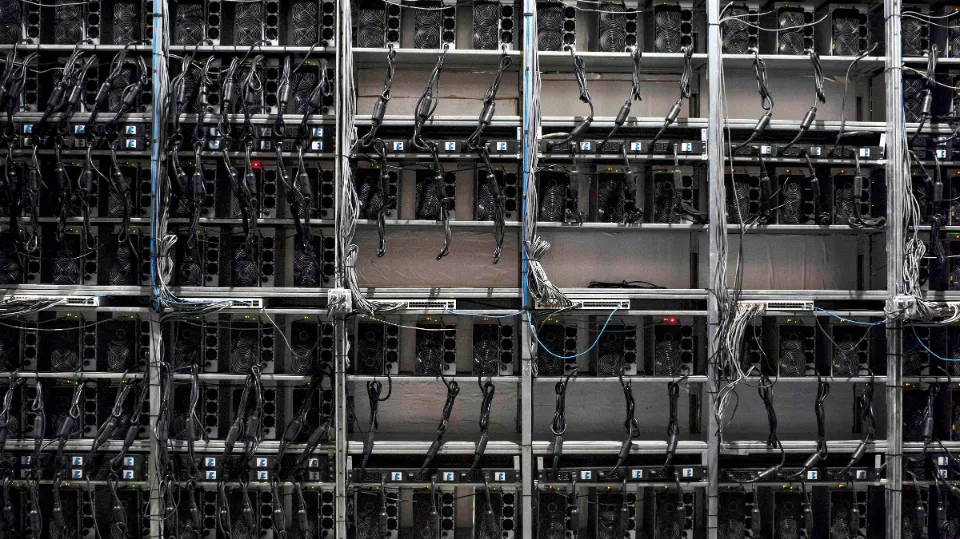

Riot Blockchain, Inc. (NASDAQ:RIOT) had a strong year last year when it grew its Bitcoin balance sheet by 353% to 4,884 Bitcoins. The firm is also aiming to deploy a staggering 116,150 Antminer application specific integrated circuits (ASICs) by January 2023 for a total power capacity of 370 megawatts.

Marathon Digital Holdings, Inc. (NASDAQ:MARA)

Market Capitalization as of December 30, 2022: $397.80 million

Marathon Digital Holdings, Inc. (NASDAQ:MARA) is an American firm that was set up in 2010 and is headquartered in Las Vegas, Nevada. The company mines Bitcoin and has a blockchain platform.

Marathon Digital Holdings, Inc. (NASDAQ:MARA) mined 616 Bitcoins during the third quarter of this year, and year to date the firm has produced 2,582 Bitcoins. These add to the 8,115 Bitcoins that Marathon Digital Holdings, Inc. (NASDAQ:MARA) by the end of December 2021.

Canaan Inc. (NASDAQ:CAN)

Market Capitalization as of December 30, 2022: $324.20 million

Canaan Inc. (NASDAQ:CAN) is a Chinese firm that assembles, designs, and sells Bitcoin mining equipment. The firm is based in Beijing, the People’s Republic of China.

Canaan Inc. (NASDAQ:CAN) sells Bitcoin mining machines such as the A1366 with a whopping 130TH/s hash rate and 3250 Watts of power consumption. The firm sold 3.5 million TH/s of computing power during the third quarter of this year, for marked decreases over the second quarter and the year ago quarter.

Hut 8 Mining Corp. (NASDAQ:HUT)

Market Capitalization as of December 30, 2022: $242.81 million

Hut 8 Mining Corp. (NASDAQ:HUT) is a Canadian firm with large scale Bitcoin mining operations. The firm is based in Toronto, Canada.

Hut 8 Mining Corp. (NASDAQ:HUT) has three mining centers. Two of these are located in Alberta and one is located in Ontario. Hut 8 Mining Corp. (NASDAQ:HUT) mined 982 Bitcoins during the third quarter of this year, which marked for 8.5% annual growth fueled by hash rate efficiency and facility expansion.

HIVE Blockchain Technologies Ltd. (NASDAQ:HIVE)

Market Capitalization as of December 30, 2022: $163.56 million

HIVE Blockchain Technologies Ltd. (NASDAQ:HIVE) is another Canadian cryptocurrency mining company. The firm is headquartered in Vancouver, British Columbia.

HIVE Blockchain Technologies Ltd. (NASDAQ:HIVE) is a pureplay Bitcoin miner with operations in Canada, Sweden, and Iceland. The firm’s Canadian mining center has 30 megawatts of capacity, its Sweden miner has 17 megawatts of capacity, and its Iceland facility, which uses geothermal electricity as well, has four megawatts of capacity.

Bitfarms Ltd. (NASDAQ:BITF)

Market Capitalization as of December 30, 2022: $120.05 million

Bitfarms Ltd. (NASDAQ:BITF) is a Canadian cryptocurrency mining firm that operates blockchain server farms. It is based in Toronto, Canada.

Bitfarms Ltd. (NASDAQ:BITF) has ten Bitcoin mining farms in the U.S., Canada, Paraguay, and Argentina. Most of these are powered by hydroelectricity and have a total planned capacity of 229 megawatts for 2022 end. Bitfarms Ltd. (NASDAQ:BITF) mined 15.7 Bitcoins daily as of October 2022 and held 2,064 Bitcoins.

Cipher Mining Inc. (NASDAQ:CIFR)

Market Capitalization as of December 30, 2022: $111.70 million

Cipher Mining Inc. (NASDAQ:CIFR) is an American Bitcoin mining firm that is a relatively younger company since it was set up in 2021. The company is based in New York, New York, United States.

Cipher Mining Inc. (NASDAQ:CIFR) mined 196 Bitcoins during the third quarter of this year, and the firm is aiming to reach a hash rate of 7 EH/s by early 2023. The company also began operations in its Odessa data center in November 2022, with its four data centers aimed to expand capacity to 267 megawatts by early 2023.

TeraWulf Inc. (NASDAQ:WULF)

Market Capitalization as of December 30, 2022: $93.12 million

TeraWulf Inc. (NASDAQ:WULF) is an American firm with Bitcoin mining facilities in New York and Pennsylvania. The firm is headquartered in Easton, Maryland.

TeraWulf Inc. (NASDAQ:WULF)’s Lake Miner data center is located right beside Lake Ontario. It aims to source up to 500 megawatts of electricity and 91% of zero carbon power. The firm’s Nautilus Cryptomine is located close to a nuclear power plant that is capable of generating 2.5 gigawatts of electricity.

Iris Energy Limited (NASDAQ:IREN)

Market Capitalization as of December 30, 2022: $60.48 million

Iris Energy Limited (NASDAQ:IREN) is an Australian firm that was set up in 2018 and is headquartered in Sydney, Australia. The firm has operations in the U.S., Canada, and Asia Pacific.

Iris Energy Limited (NASDAQ:IREN) has 530 megawatts or 15.2 EH/s of operated and contracted capacity. The firm’s Canadian data center has a 30 megawatts capacity and a hash rate of 0.7 EH/s. Iris Energy Limited (NASDAQ:IREN)’s data centers are powered by renewable energy and it mined 448 Bitcoins in October 2022.

Bit Digital, Inc. (NASDAQ:BTBT)

Market Capitalization as of December 30, 2022: $46.98 million

Bit Digital, Inc. (NASDAQ:BTBT) is an American firm that was set up in 2017 and is headquartered in New York, New York, the United States.

Bit Digital, Inc. (NASDAQ:BTBT) mines both Bitcoin and Ethereum, and the bulk of operations focus on the former. The firm has a whopping 38,866 Bitcoin miners in its mining fleet with a hash rate of 2.7 EH/s. As of June 2022, Bit Digital, Inc. (NASDAQ:BTBT) had mined 3,967 Bitcoins.

BitNile Holdings, Inc. (NYSE:NILE)

Market Capitalization as of December 30, 2022: $35.68 million

BitNile Holdings, Inc. (NYSE:NILE) is a Bitcoin firm that was set up in 1969 and is headquartered in Las Vegas, Nevada. The firm not only mines Bitcoin, but it is also a defense contractor and a hotel and data center operator.

BitNile Holdings, Inc. (NYSE:NILE) owns two Bitcoin mining companies. These are Alliance Cloud Services and Bitcoin Miners. Bitcoin Miners operated 1,705 miners as of January 2022 with a hash rate of 170.5 PH/s, and Alliance owns a large data center for bitcoin mining and cloud hosting solutions.

Core Scientific, Inc. (NASDAQ:CORZ)

Market Capitalization as of December 30, 2022: $31.94 million

Core Scientific, Inc. (NASDAQ:CORZ) is an American firm that mines digital assets and provides blockchain networks for transaction processing. The firm is headquartered in Austin, Texas.

Core Scientific, Inc. (NASDAQ:CORZ) mines a host of different cryptocurrencies. These include Bitcoin, Ethereum, Monero, Nervos, and Litecoin. The firm also provides hosting facilities for mining. Core Scientific, Inc. (NASDAQ:CORZ) is the world’s largest publicly traded mining firm in terms of computing power.

Argo Blockchain plc (OTCMKTS:ARBKF)

Market Capitalization as of December 30, 2022: $31.06 million

Argo Blockchain plc (OTCMKTS:ARBKF) is a British company that is headquartered in London, the United Kingdom. The firm mines Bitcoin from its facilities in North America.

Argo Blockchain plc (OTCMKTS:ARBKF) has three Bitcoin mining facilities. These Helios, Baie Comeau, and Mirabel centers. Out of these, Mirabel is Argo Blockchain plc (OTCMKTS:ARBKF)’s oldest facility, while Helios is the largest. Helios is located in Texas and it uses 200 megawatts of power.

BIT Mining Limited (NYSE:BTCM)

Market Capitalization as of December 30, 2022: $14.18 million

BIT Mining Limited (NYSE:BTCM) is a cryptocurrency mining company that is headquartered in Hong Kong. The firm also has a cryptocurrency wallet and it was set up in 2001.

BIT Mining Limited (NYSE:BTCM)’s data center in Ohio has a power capacity of a whopping 82.5 megawatts. It mines Bitcoin and Ethereum, and its theoretical maximum Bitcoin hash rate is 971.1 PH/s. The firm’s Hong Kong data center has mining power of 1.4 megawatts.

Four out of the 920 hedge funds part of Insider Monkey’s Q3 2022 poll had bought BIT Mining Limited (NYSE:BTCM)’s shares.

Greenidge Generation Holdings Inc. (NASDAQ:GREE)

Market Capitalization as of December 30, 2022: $12.29 million

Greenidge Generation Holdings Inc. (NASDAQ:GREE) is an American firm that was set up in 1937. The firm generates power and also mines Bitcoin. It is headquartered in Fairfield, Connecticut.

Greenidge Generation Holdings Inc. (NASDAQ:GREE) mined roughly 866 bitcoin during the third quarter of this year, as it operated 24,500 mining centers and had a mining capacity of 2.4 EH/s. The firm built on the third quarter performance, by mining another 269 bitcoins in October 2022.

Insider Monkey surveyed 920 hedge fund portfolios for their third quarter of 2022 investments to discover that three had bought Greenidge Generation Holdings Inc. (NASDAQ:GREE)’s shares.

Greenidge Generation Holdings Inc. (NASDAQ:GREE)’s largest investor is Jim Simons’ Renaissance Technologies which owns 380,000 shares that are worth $618,000.

Is It Time to Invest in Crypto Mining?

The mining stocks were rapidly increasing up until the end of 2021, when cryptocurrency prices peaked. On every price chart we included in this article, a significant increase in November can be seen.

The recent decline in the price of cryptocurrencies has made matters worse for the crypto mining companies, who have been in a precarious position for months. We are probably in the midst of a shakeout, where only the most resilient mining firms will endure.

The NASDAQ-listed mining company Core Scientific issued a warning at the end of October indicating that if things don’t get better, it might declare bankruptcy by the end of the year. Similar reservations were made by the London-listed Argo Blockchain. And Computer North, a US-based company that operates one of the biggest crypto mining data centers, recently declared bankruptcy with $500 million in liabilities.

The crypto mining industry is currently risky to invest in. The businesses listed in this article do, however, have healthier balance sheets and the ability to survive until the next rally despite the protracted crypto winter.

The majority of the stocks in the crypto mining industry are currently discounted, which is a benefit to investing in this sector. We anticipate that bitcoin miners will prosper if it stabilizes above $20,000 and tries to move higher.

If you are a traditional investor with no crypto exposure, investing in the crypto mining sector might be a great diversification approach, and now could be a great time to “buy the bottom.”

The problem is that the cryptocurrency market’s recovery could drag on for a while. And if you decide to add some shares of mining giants to your portfolio at this time, be careful because you might need to hold them for several months before the market turns green once more.

Always conduct your own research and only invest money you can afford to lose. We advise investing no more than 10% of your total portfolio in cryptocurrencies and assets related to them.

Conclusion: Do Your Research

Speaking with a financial advisor or using a stock trading platform like TD Ameritrade, Fidelity, or Robinhood are both simple ways to invest in bitcoin mining companies. Investing in mining companies may be a less complicated way to get exposure to bitcoin while the crypto winter is still driving prices down.

- Two of the biggest potential growth markets of a generation may be missed if you completely exclude cryptocurrencies and the metaverse from your portfolio.

- A quick glance at the bitcoin breakout kit from META, U, MSFT, RIOT, SQ, NVDA, and Q.ai.

- The markets for cryptocurrencies and the metaverse are new and unproven, making them riskier in the short term but promising for long-term investors. If you were bullish, your portfolio might consist of 5–10% of these stocks.

FAQs

Which Bitcoin Mining Stock is the Best?

According to our research, these Bitcoin mining stocks are excellent buys. Investors currently undervalue Hut 8 Mining, Stronghold, HIVE, and Canaan, making them all good buys. All of these stocks offer the possibility of high returns at a low barrier to entry due to their low trading prices.

Who is the Biggest Bitcoin Miner?

The biggest bitcoin mining operation in the world is Core Scientific.

Is Mining Bitcoin a Good Investment?

Yes, bitcoin mining can be profitable if you invest in the right tools and join a bitcoin mining pool. A high profit isn’t guaranteed, though, and there are many unknowns. Not everyone is suited for mining.

Can You Become Rich by Mining Bitcoin?

Bitcoin mining can be a lucrative way to make money with Bitcoin, but not for individual investors. The initial and ongoing costs can greatly exceed mining rewards due to the required computing power.