The oldest and most valuable cryptocurrency, Bitcoin (BTC), ended 2017 with a loss of more than 60%. The mining sector was also negatively impacted by the sharp drops in BTC prices, with revenues dropping by 37.5% to $9.55 billion in 2022.

Bitcoin Miners’ Revenue Took a Dive in 2022

Data from Glassnode shows that in 2021, mining revenues totaled $15,3 billion. However, the public failure of the TerraUSD ecosystem in May and then the FTX cryptocurrency exchange in November had a negative impact on the sector as a whole.

Additionally, pressure on risk assets, such as equities, has increased as interest rates increase globally. Cryptocurrencies, which have a strong relationship with the stock market, started to decline as well, which had a bad effect on the state of the companies that mine digital assets.

In November 2021, the mining industry’s daily revenue index surpassed a previous high of $63 million. But by the end of 2022, it had only dropped to $16 million, registering a very rapid depreciation.

The sharp decline in revenues is being caused by three main factors, according to Doug Brooks, Senior Advisor at XinFin Foundation: a significant increase in energy costs, a decline in the value of Proof of Work currencies like Bitcoin, and escalating competition.

“There are more miners than ever now, some are even publicly listed companies, so there is less bounty for each miner since the pot size is limited,” Brooks commented.

BTC Miners’ Debts Grow

Bitcoin miners struggled to pay back their debts as revenues and profitability fell. The debt-to-equity ratio tripled for many well-known and publicly traded mining companies, according to Luxor data.

For Core Scientific, one of the Wall Street-based Bitcoin miners, the ratio reached 26.7. One of the biggest miners in the world, Argo Blockchain (NASDAQ: ARBK), also increased its debt, with the debt-to-equity ratio rising to 8.7.

As of September 30, 2022, Core Scientific owed $1.3 billion, which ultimately prompted the company to file for bankruptcy. On the other hand, Greenidge and Stronghold made the decision to restructure their current liabilities. The ten miners that Luxor looked at had a combined debt of nearly $3.5 billion.

Will debt and bankruptcies increase in 2023? According to Brooks, it “can most certainly be expected in the mining industry this year, particularly if the prices of More currencies based on PoW, including Bitcoin, are falling.”

“There hasn’t been a noticeable drop in energy prices, and switching to a more sustainable and economical energy source would be expensive and time-consuming where it was possible. The survival of many miners must be in jeopardy until any significant price bounce because they are already working at or below break-even levels. Any further increase in cost or reductions in revenues will accelerate the shutting down of those in the weakest positions,” Brooks added.

Significant Losses of Bitcoin Mining Companies

Despite the fact that the biggest publicly traded mining companies have not yet made their reports for the fourth quarter and all of 2022 public, the most recent trading updates and third-quarter reports indicated a significant decline in the industry’s health.

Manufacturer of cryptocurrency mining hardware Canaan Inc. (NASDAQ: CAN) reported a sharp decline in revenue and net income in November. The provider of computing solutions generated $137.5 million in revenue over the three months that ended on September 30, 2022, which is 26% less than in the prior year. Net income fell to $8.6 million, a 90% decrease from the previous quarter.

Despite increased BTC production, the cryptocurrency mining company Bitfarms (NASDAQ: BITF) reported a decline in revenue for the same quarter. A total of 1,515 BTC were mined by the company in the third quarter, up nearly 500 from the same period in 2017.

When Mike Novogratz’s financial company Galaxy Digital Holdings, Ltd., which specializes in digital assets, reached a strategic agreement with Argo Blockchain, the company was saved from going under.

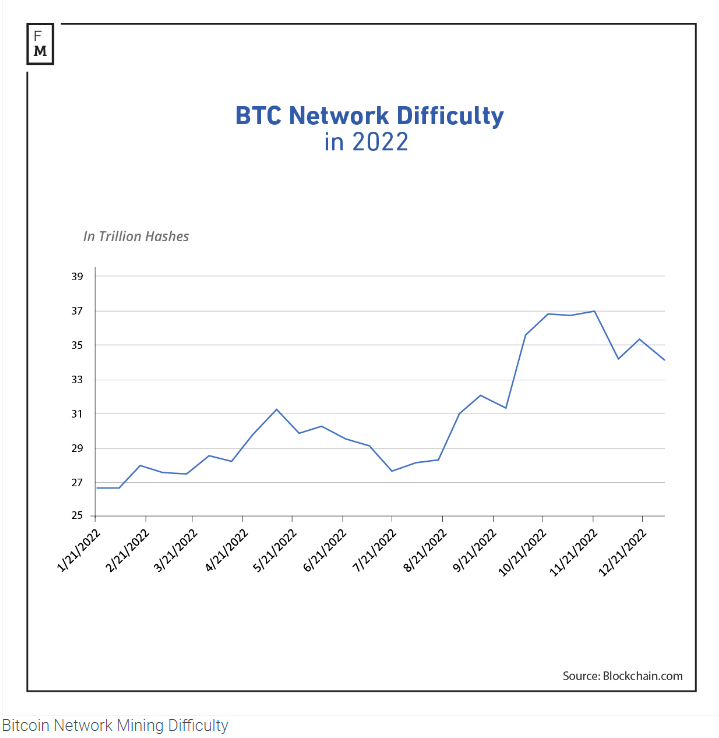

Bitcoin Network Difficulty Keeps Growing

The cost of mining Bitcoin has increased throughout 2022 despite a decline in profitability, as has the price of BTC. It is evident that the level of competition in the market has been steadily rising despite the challenging circumstances.

Beginning in 2022, it took 24 trillion hashes (TH) to create a brand-new Bitcoin, but 12 months later, the indicator reached a new all-time high of 37 trillion hashes. Since then, the mining challenge has slightly decreased to 35 TH, but it is still within the realm of record highs.