Even with the price of bitcoin trading at $24,000, the pressure on bitcoin miners has lasted for more than a year. BTC mining stocks may still encounter difficulties in 2023.

Because the price of bitcoin directly affects a company’s earnings, bitcoin mining stocks typically track the price of bitcoin. In the final three months of 2022, these stocks were severely depressed, particularly in December. The largest U.S. company filing for bankruptcy made the slump following FTX’s demise worse.-based Core Scientific is a bitcoin mining firm.

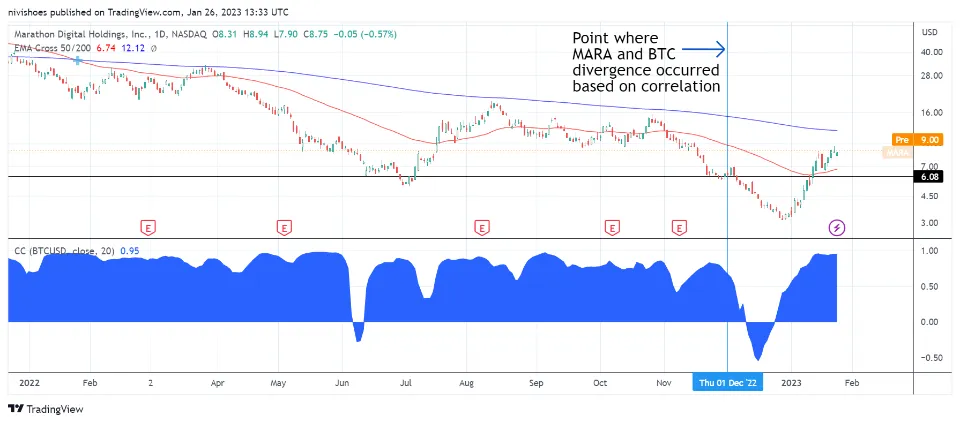

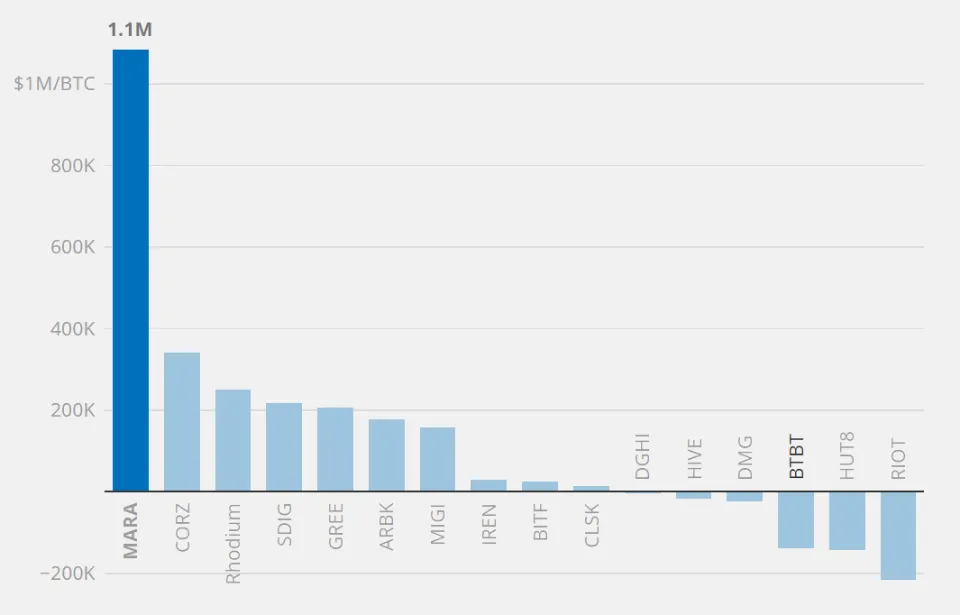

Other mining stocks, such as Marathon Digital Holdings (MARA) in the graph below, showed a sluggish correlation with Bitcoin’s price during this time, indicating that December’s decline was probably exaggerated.

Beginning in 2023, the downward trend began to turn around as most mining stocks registered significant gains. The average price of publicly traded mining and hardware manufacturing companies is tracked by the mining stock index Hashrate Index, which has grown by 62.5% so far this year. The price increase also restored the BTC price’s strong correlation with mining stock prices.

The mining sector is still under pressure, and it is anticipated that profits will remain low for a while. Mining firms have been able to finance their operations since Q2 2022 by selling Bitcoin from their reserves and newly mined Bitcoin, as well as by taking on debt and issuing new shares. The industry will probably see a few takeover attempts or additional treasury sales to pay off debt unless Bitcoin’s price stabilizes above $25,000.

Some Mining Companies Are Operating at a Loss

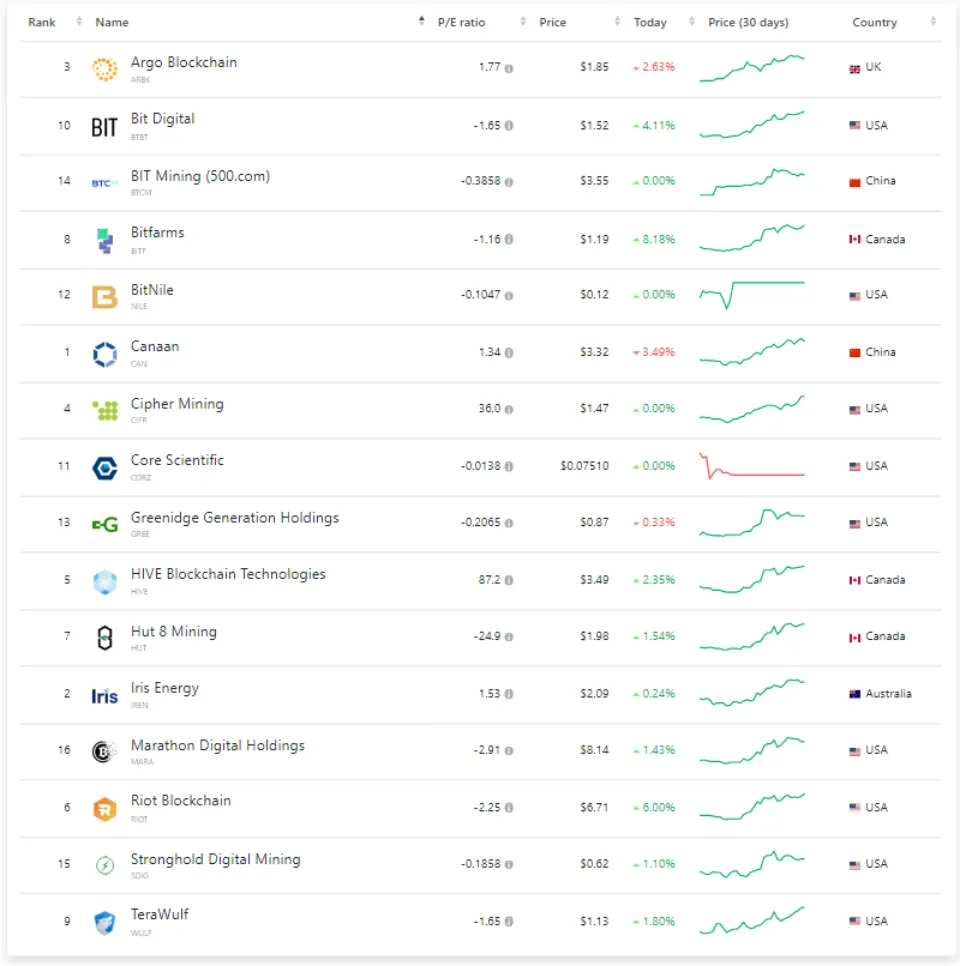

The price-to-earnings (PE) ratio of the top mining companies is currently negative, indicating that they are likely losing money and making their stock prices susceptible to sharp declines.

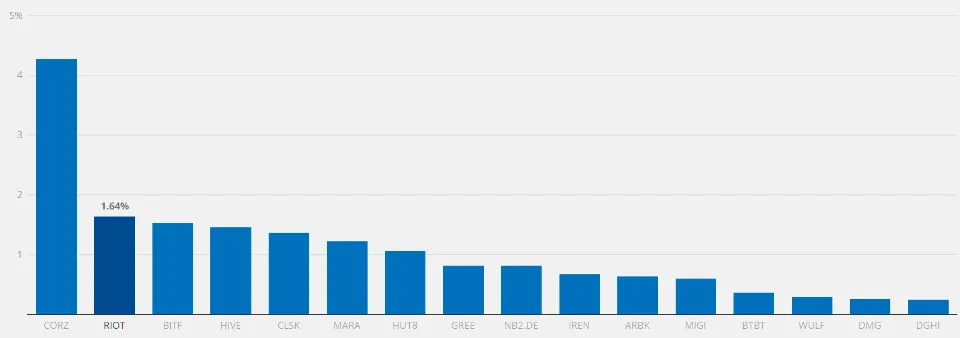

The largest publicly traded Bitcoin mining companies with over 1% of the global hash rate share are Riot Blockchain, Bitfarms Ltd, Hive Blockchain Technologies, Cleanspark Inc, Marathon Digital Holdings, and Hut 8 Mining. A combined share of about 19% belongs to the top 15 publicly traded mining firms.

Notably, the majority of businesses in the sector have a PE ratio between 0 and 2, with the exception of Marathon, Hive, and Hut 8. This raises concerns that these businesses may be overvalued at the present time.

Because markets are typically forward-looking, a net loss position is not a reason to disregard a stock. The mining stocks are obvious picks for someone who has a long-term bullish outlook on Bitcoin. Before reaping the rewards of the upcoming bull run, these businesses must endure the bear market.

Shareholders Suffered Losses Due to Bad Debt and Dilution

Businesses that are heavily leveraged or indebted and must pay interest are particularly stressed and at risk of going bankrupt.

Each unit of Bitcoin mining costs Marathon, Greenidge, and Stronghold more than $200,000, with Marathon’s debt reaching a maximum of $1.1 million. In its treasury, Marathon used Bitcoin as collateral for loans, and the company now has 10,055 BTC worth about $235 million in its possession.

By the end of October, Marathon had $100 million in loans, which run the risk of being repaid in full if Bitcoin’s price drops below the threshold set for the loans. For example, if the loan threshold is 150%, the business will be compelled to sell some of its BTC in order to pay off the loans if the price of Bitcoin falls below $15,000.

Hive, Hut8, and Riot are encouraging examples of companies that are largely debt-free and rely on equity funding in this regard. This eases the burden of making interest payments on the debt and gives the company more leeway to raise money or expand by grabbing a portion of the market share left over from now-insolvent mining operations.

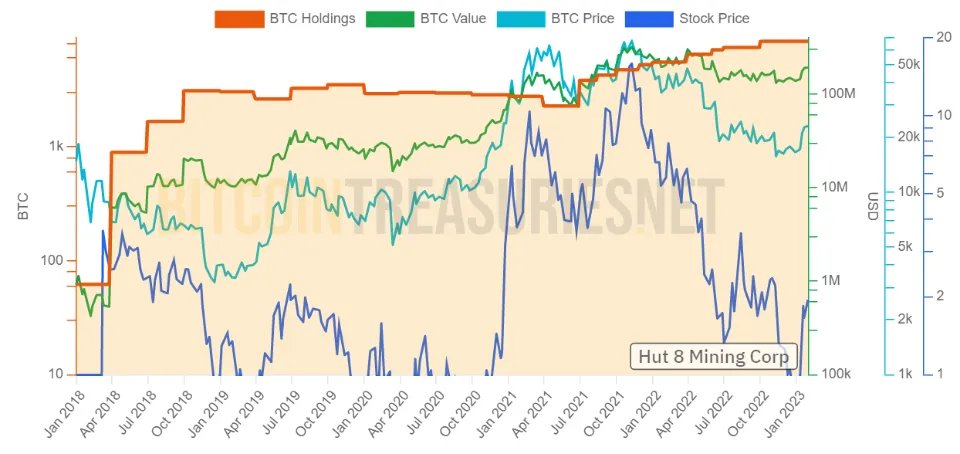

There is yet another method of fundraising, though. Miners can dilute their shares rather than issue more debt. In exchange for more stock, the companies receive investments from investors on the open market. As a result, shareholders own less of the company. By Q2 2022, Hut 8 Mining and Riot’s shares had been diluting by more than 40%. In the same year’s third quarter, Hut 8 once more dilutive about 15% of its shares.

Excessive dilutions have greatly decreased the value of investor holdings, while the need to raise capital has exposed these indebted companies to liquidation risks.

Mining Company Mandates on Treasury Holdings

The Bitcoin treasury levels of mining companies are being kept low despite their struggles with profitability. Marathon was able to keep its level of Treasury holdings despite suffering losses since Q2 2022.

In contrast, Hut 8 Mining sells its mined BTC in a more aggressive manner. Due to this, since mid-2022, its holdings have significantly increased.

While other companies, including Riot and Hive, have turned to use their BTC treasury to pay for operational and growth expenses. Since the third quarter of 2022, when Hive’s holdings dropped from 4,032 BTC to 2,348 BTC, they have significantly decreased. In order to survive, Hive must increase the number of its miners and cut costs.

Without a doubt, Bitcoin mining companies are still susceptible to changes in the price of bitcoin, debt liquidations, and shareholder losses from excessive dilution. The entire mining industry will be taken over by entities in 2023, predicts Ki Young Ju, the founder of Crypto Quant and an on-chain analyst.

Even though this won’t have much of an impact on Bitcoin’s price, mining stocks are still at risk of suffering sizable losses.