The bitcoin (BTC) mining business Greenidge Generation has significantly reduced its debt to New York Digital Investment Group (NYDIG), an investment management company.

On January 30, Greenidge and NYDIG entered into a number of agreements related to their secured debt, transferring ownership of Bitcoin mining equipment and specific credits to NYDIG. A total aggregate debt reduction of about $59 million was achieved as a result of the transaction, which decreased the principal and accrued interest balance of the debt owed to NYDIG from approximately $76 million to roughly $17 million.

One of the agreements, the senior secured loan agreement, also provides a way for a loan to be voluntarily prepaid by transferring ownership of specific mining infrastructure assets. The loan agreement may reduce the principal balance of the debt to approximately $7 million, subject to a binding agreement by NYDIG.

As was previously mentioned, Greenidge initially signed the agreement in the middle of December, anticipating a debt reduction of at least $57 million and as much as $68 million for NYDIG.

“According to Greenidge CEO Dave Anderson, the debt restructuring we announced today significantly strengthens our balance sheet and gives us a certain course of action as we approach 2023. The exec expressed confidence about the strong mining industry development ahead, stating:

“Our immediate liquidity has significantly improved as a result of this debt restructuring being finished, and we are now able to continue taking advantage of Bitcoin’s potential future growth thanks to the execution of the new hosting contracts.”

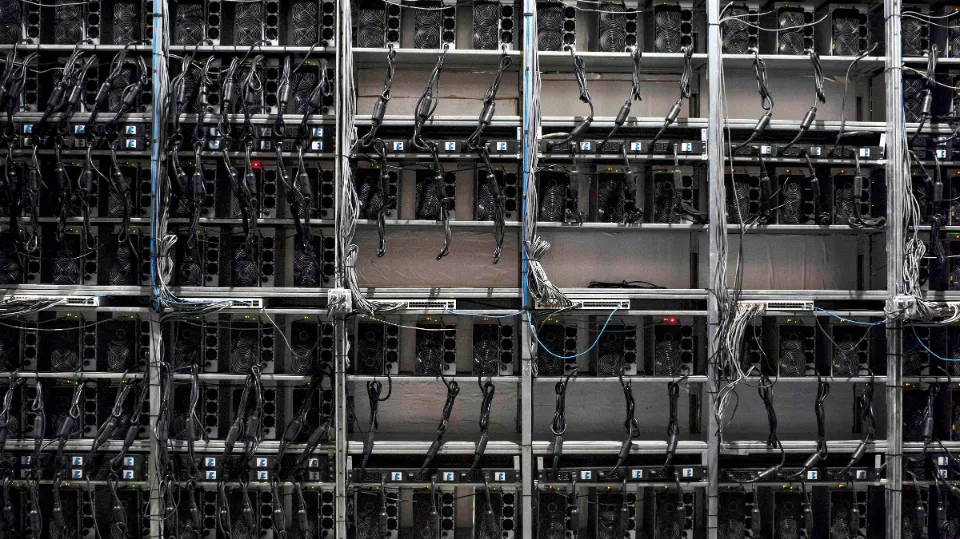

Greenidge still owns about 10,000 mining rigs and has a capacity of 1.1 exahashes per second (EH/s) despite essentially restructuring the business into a hosting company for Bitcoin mining rigs, the company claimed.

Numerous mining companies have been using similar tactics to reduce their debt amid a challenging cryptocurrency winter. Argo Blockchain sold its primary Helios mining facility at the end of December, reducing its total debt by $41 million, and secured a $35 million loan from Mike Novogratz’s cryptocurrency investment company Galaxy Digital.

In addition to the debt reduction, Greenidge also disclosed its preliminary financial results for the fourth quarter of 2022, which showed $15 million in revenues and losses of up to $130 million. During Q4 2022, the company generated roughly 683 BTC ($15.7 million).

In addition, Greenidge mentioned the sale of its software subsidiary Support.com in January. 17. A net profit of about $2.6 million was realized from the sale.